ASTRALIS Considers Delisting from NASDAQ: Shocking Decision Expected!

Astralis, the Danish company that entered the market in 2019, has announced its decision to seek delisting from the Nasdaq First North Growth Market Denmark. The company plans to hold an extraordinary general meeting on August 8, 2023, where shareholders will vote on the proposal.

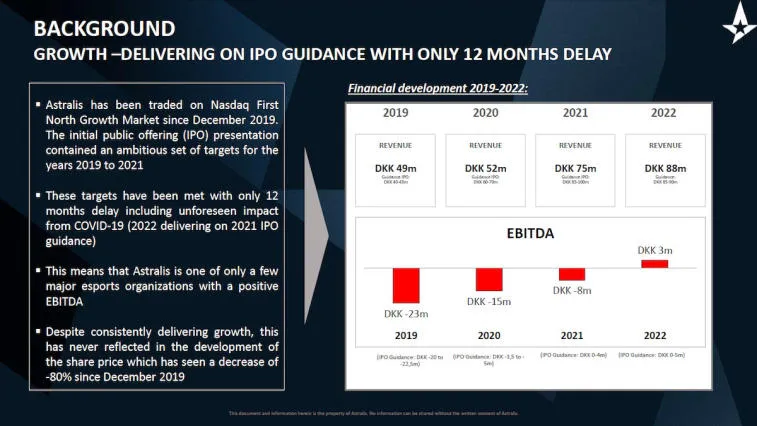

Since its initial public offering (IPO), Astralis' share price has experienced a significant decline, dropping by 80%. Despite this, the company has achieved its financial targets, diversifying revenue streams and separating revenue and profit from in-game team performance. In 2022, Astralis reported positive EBITDA and became cash-flow positive after three years, demonstrating overall growth as a sustainable business. The annual revenue also increased from 49 million DKK ($7.1 million) in 2019 to 88 million DKK ($12.8 million) in 2022.

However, the limited liquidity of the company's shares on the Nasdaq First North Growth Market Denmark has posed challenges. Astralis believes that the low trading volume and the substantial discount to the IPO price have hindered its ability to participate in market consolidation and acquisitions on favorable terms for shareholders. Additionally, the costs associated with being listed on the Nasdaq exchange, estimated to be between 2-3 million DKK annually, could be better allocated to other areas.

Delisting from the market would relieve Astralis from disclosure obligations for market abuse regulation applied to listed companies on the Nasdaq. The company emphasizes that the proposal to delist will be the primary agenda item during the extraordinary general meeting, requiring a two-thirds majority vote in favor for it to pass. The executive management, board of directors, and major shareholder Jakob Lund Kristensen have all confirmed their support for the delisting proposal.

Commentaires